Although several option-pricing methods are well known and widely used, probably the most intuitive and flexible method is the binomial lattice option-pricing model originally developed by Cox, Ross and Rubinstein (1979) Cox, J. The real options approach fulfills these conditions and has been widely discussed in the academic and practitioner literature.

Given that the flexibility to adapt to changes in expected future cash flows has option-like characteristics, they can only be valued with option-pricing methods. In order to value project cash flows which can flexibly change their trajectory, as future uncertainties are resolved, it is necessary to use a more adequate approach. Nevertheless, in the case of real assets, this principle does not account for the uncertainty over the future behavior of the cash flows nor for the value generated by the flexibility some projects have to react to future events. It is a well-established principle in Finance and Economics that the correct measure of an asset are the future cash flows it generates, discounted to the present time at an appropriate risk-adjusted rate. Real options approach (ROA) was developed to overcome the limitations of the discounted cash flow method by using option-pricing methods to capture the value of any managerial flexibility that may be embedded in a project subject to future uncertainty. Tutorial opções reais árvore binomial volatilidade de projetos fluxo de caixa Conclusões: como contribuição, este tutorial fornece um mecanismo simples para analisar oportunidades de investimento em projetos que possuem incerteza e flexibilidade. Os resultados mostram como as opções reais podem afetar o valor de projetos. Nosso código considera a estimativa correta da volatilidade do projeto, a modelagem do rendimento de dividendos e a construção da treliça.

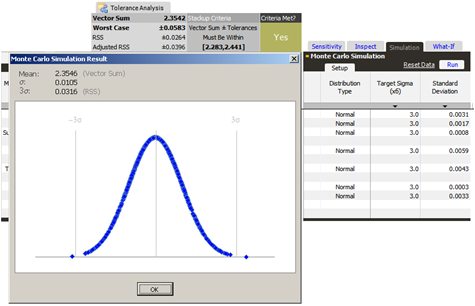

#REAL OPTIONS VALUATION MONTE CARLO SOFTWARE#

Neste tutorial, propomos um código em software aberto com diretrizes intuitivas para ajudar pesquisadores e profissionais a modelar malhas binomiais de opções reais a partir de fluxos de caixa de projetos. New York: Texere Publishing Limited., que considera os fluxos de caixa do projeto como dividendos. Ser de simples implementação para opções financeiras, essa modelagem para opções reais requer uma abordagem diferente, como a proposta por Copeland e Antikarov (2001) Copeland, T., & Antikarov, V. Journal of Financial Economics, 7(3), 229-263.

Apesar de o modelo de árvore binomial de Cox, Ross e Rubinstein (1979) Cox, J. Mas as árvores binomiais recombinantes, conhecidas como treliças, talvez sejam uma das abordagens mais práticas e intuitivas para modelar incertezas e precificar flexibilidades gerenciais de projetos. Tutorial real options lattice model project volatility cash flowĭiversos métodos para avaliação de opções reais foram extensivamente estudados e publicados. Conclusions: as a contribution, this tutorial provides a simple mechanism for analyzing investment opportunities in projects that have uncertainty and flexibility. The results show how real options can affect the value of projects.

#REAL OPTIONS VALUATION MONTE CARLO CODE#

Our code considers the correct project’s volatility estimation, dividend yield modeling, and lattice building. In this tutorial, we propose a code in an open-source software with intuitive guidelines to help researchers and practitioners model real options lattices from project cash flows. New York: Texere Publishing Limited., which considers project cash flows as dividends in the lattice model. Lattice model is simple to implement for financial options, modeling real options lattices requires a different approach such as the one proposed by Copeland and Antikarov (2001) Copeland, T., & Antikarov, V. Although the Cox, Ross, and Rubinstein (1979) Cox, J. But recombining binomial trees, known as lattices, are perhaps one of the most practical and intuitive approaches to model uncertainty and price project managerial flexibilities for real options applications. Several methods for evaluating real options have been extensively studied and published. Luiz Eduardo Teixeira Brandão*, Pontifícia Universidade Católica do Rio de Janeiro, IAG - Escola de Negócios. E-mail address: Luiz Eduardo Teixeira Brandão E-mail address: Carlos de Lamare Bastian-PintoĬarlos de Lamare Bastian-Pinto, Pontifícia Universidade Católica do Rio de Janeiro, IAG - Escola de Negócios. Naielly Lopes Marques, Pontifícia Universidade Católica do Rio de Janeiro, IAG - Escola de Negócios. Pontifícia Universidade Católica do Rio de Janeiro, IAG - Escola de Negócios, Rio de Janeiro, RJ, Brazil.

0 kommentar(er)

0 kommentar(er)